| (10) | Nonqualified Deferred Compensation

We do notThe RSAs were granted to Dr. Molnar on March 3, 2020, as part of his offer our executives or other employees any nonqualified deferred compensation.

Outstanding Equity Awards at December 31, 2018

The following tables include certain information with respectof employment. This grant is subject to equity awards held by our named executive officers astime-based vesting in four equal annual installments on the first four anniversaries of December 31, 2018, based on a closing stock price of $15.65 on that date:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Option Awards | | | Stock Awards | | Name | | Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable | | | Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable | | | Equity

Incentive

Plan

Awards:

Number of

Securities of

Underlying

Unexercised

Unearned

Options

(#) | | | Option

Exercise

Price

($) | | | Option

Expiration

Date | | | Number of

Shares or

Units of

Stock that

Have not

Vested

(#) | | | Market

Value of

Shares

or Units

of Stock

that

Have

Not

Vested(12)

($) | | | Equity

Incentive

Plan Awards:

Number of

Unearned

Shares, Units

or Other

Rights that

Have Not

Vested

(#) | | | Equity

Incentive

Plan Awards:

Market or

Payout Value

of Unearned

Shares, Units

or Other

Rights that

Have Not

Vested(12)

($) | | Mary Anne Heino | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Options(1) | | | 44,484 | | | | — | | | | — | | | | 19.11 | | | | 04/15/23 | | | | | | | | | | | | | | | | | | RSAs(2) | | | | | | | | | | | | | | | | | | | | | | | 22,242 | | | | 348,087 | | | | — | | | | — | | RSAs(3) | | | | | | | | | | | | | | | | | | | | | | | 56,750 | | | | 888,138 | | | | — | | | | — | | RSAs(4) | | | | | | | | | | | | | | | | | | | | | | | 132,500 | | | | 2,073,625 | | | | — | | | | — | | RSAs(5) | | | | | | | | | | | | | | | | | | | | | | | 43,986 | | | | 688,381 | | | | — | | | | — | | RSAs(6) | | | | | | | | | | | | | | | | | | | | | | | 60,126 | | | | 940,972 | | | | — | | | | — | | PSAs(7) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 79,169 | | | | 1,238,995 | | PSAs(8) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 60,127 | | | | 940,988 | | | | | | | | | | | | Robert J. Marshall, Jr. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | RSA(9) | | | | | | | | | | | | | | | | | | | | | | | 44,642 | | | | 698,647 | | | | | | | | | | | | | | | | | | | | Michael Duffy | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Options(10) | | | 24,911 | | | | — | | | | — | | | | 18.66 | | | | 08/05/23 | | | | | | | | | | | | | | | | | | RSAs(2) | | | | | | | | | | | | | | | | | | | | | | | 17,794 | | | | 278,476 | | | | — | | | | — | | RSAs(3) | | | | | | | | | | | | | | | | | | | | | | | 12,375 | | | | 193,669 | | | | — | | | | — | | RSAs(4) | | | | | | | | | | | | | | | | | | | | | | | 31,000 | | | | 485,150 | | | | — | | | | — | | RSAs(5) | | | | | | | | | | | | | | | | | | | | | | | 10,979 | | | | 171,821 | | | | — | | | | — | | RSAs(6) | | | | | | | | | | | | | | | | | | | | | | | 12,483 | | | | 195,359 | | | | — | | | | — | | PSAs(7) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 19,762 | | | | 309,269 | | PSAs(8) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 12,484 | | | | 195,375 | | | | | | | | | | | | Cesare Orlandi | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Options(11) | | | 26,690 | | | | — | | | | — | | | | 21.10 | | | | 03/04/23 | | | | | | | | | | | | | | | | | | Options(10) | | | 8,896 | | | | — | | | | — | | | | 18.66 | | | | 08/05/23 | | | | | | | | | | | | | | | | | | RSAs(2) | | | | | | | | | | | | | | | | | | | | | | | 7,117 | | | | 111,381 | | | | — | | | | — | | RSAs(3) | | | | | | | | | | | | | | | | | | | | | | | 10,000 | | | | 156,500 | | | | — | | | | — | | RSAs(4) | | | | | | | | | | | | | | | | | | | | | | | 22,500 | | | | 352,125 | | | | — | | | | — | | RSAs(5) | | | | | | | | | | | | | | | | | | | | | | | 6,224 | | | | 97,406 | | | | — | | | | — | | RSAs(6) | | | | | | | | | | | | | | | | | | | | | | | 12,814 | | | | 200,539 | | | | — | | | | — | | PSAs(7) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 11,203 | | | | 175,330 | | PSAs(8) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 12,815 | | | | 200,555 | | | | | | | | | | | | John W. Crowley | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

(1) | These options were granted to Ms. Heino upon her hire on April 15, 2013. These options were fully vested as of December 31, 2018.

|

(2) | These RSAs were granted on April 6, 2015. Each of these grants vest in two equal installments on each of the second and fourth anniversaries of the grant date, generally subject to the named executive officer’s continued employment.

|

(3) | These RSAs were granted to Ms. Heino on August 31, 2015 and Mr. Duffy and Dr. Orlandi on September 1, 2015. Each of these grants vest in four equal installments on each of the first four anniversaries of the grant date, generally subject to the named executive officer’s continued employment.

|

(4) | These RSAs were granted on April 26, 2016. Each of these grants vest in four equal installments on each of the first four anniversaries of the grant date, generally subject to the named executive officer’s continued employment.

|

(5) | These RSAs were granted on February 23, 2017. Each of these grants vest in three equal installments on each of the first three anniversaries of the grant date, generally subject to the named executive officer’s continued employment.

|

(6) | These RSAs were granted on March 5, 2018. Each of these grants vest in three equal installments on each of the first three anniversaries of the grant date, generally subject to the named executive officer’sthe grant date, generally subject to Dr. Molnar’s continued employment.

|

(7) | These PSAs were granted on February 23, 2017. Each of these grants are earned based on the achievement of specified revenue and adjusted EBITDA goals in 2017, 2018 and 2019, as described in further detail under “Long-Term Equity Incentive Awards” above and, to the extent earned, vest on February 23, 2020, subject to the named executive officer’s continued employment. These PSAs are reported assuming the maximum level of achievement of performance targets.

Option Exercises and Stock Vested for Fiscal 2020 | | | | | | | | | | | | | | Name | | Option Awards | | Stock Awards | | | Number of Shares

Acquired on Exercise

(#) | | Value Realized on

Exercise ($) | | Number of Shares

Acquired on Vesting

(#) | | Value Realized on

Vesting ($)(1) | | | | | | | Mary Anne Heino | | — | | — | | 191,835 | | $2,902,610 | | | | | | | Robert J. Marshall, Jr | | — | | — | | 14,485 | | $202,064 | | | | | | | John J. Bolla | | — | | — | | 8,347 | | $120,731 | | | | | | | Michael P. Duffy | | — | | — | | 45,677 | | $692,442 | | | | | | | Dr. Istvan Molnar | | — | | — | | — | | — |

| (1) | The amounts shown in this column represent the number of shares vested multiplied by the closing price of our common stock on the vesting day. |

(8) | These PSAs were granted on March 5, 2018. Each of these grants are earned based on the achievement of relative Total Shareholder Return, as described in further detail under “Long-Term Equity Incentive Awards” above and, to the extent earned, vest on March 5, 2021, subject to the named executive officer’s continued employment. These rTSR PSAs are reported assuming the target level of achievement of performance targets.

|

(9) | These RSAs were granted to Mr. Marshall on October 15, 2018 as part of his offer of employment. This grant is subject to time-based vesting in four equal annual installments on the first four anniversaries of the grant date, generally subject to Mr. Marshall’s continued employment.

|

(10) | These options were granted to Mr. Duffy and Dr. Orlandi on August 5, 2013. These options were fully vested as of December 31, 2018.

|

(11) | These options were granted to Dr. Orlandi upon his hire on March 4, 2013. These options were fully vested as of December 31, 2018.

|

(12) | The market value of unvested RSAs and PSAs was calculated by multiplying the closing price of our common stock on December 31, 2018 ($15.65), by the number of unvested RSAs and PSAs.

|

Employment Agreements; Severance and Potential Payments Upon Termination or Change of Control Our President and CEO and her direct reports at the Senior Vice President level and above, including Messrs. Marshall, Bolla and Duffy and Dr. Molnar, have entered into severance arrangements approved by the Compensation Committee, in consultation with Pearl Meyer. In exchange for being bound by certain restrictive covenants and providing a release and waiver in favor of the Company, in the event of a termination of employment without cause or a resignation for good reason, these arrangements provide for the following severance payments and benefits, in each case payable by the Company in substantially equal installments over 12 months following such employee’s separation date, subject to certain exceptions: | • | | Non-Change of Control As of December 31, 2018, Ms. Heino, Mr. Duffy and Dr. Orlandi were each party to an employment agreement that provided severance payments and benefits in the event of a termination of the named executive officer’s employment by the Companywithout cause (as defined in the applicable agreement) in an amount equal to the sum of (i) the executive’s annual base salary on the date of termination of employment, (ii) a pro rata portion (based upon the percentage of the fiscal year elapsed through the date of the executive’s termination of employment) of a specified percentage of the executive’s base salary (85% for Ms. Heino, 50% for Mr. Duffy, 50% for Dr. Orlandi), which amounts described in clause (i) and (ii) would be payable in substantially equal installments over a12-month period, and (iii) an amount equal to the Company’s portion of the COBRA premiums for 12 months, in addition to any earned and unpaid bonus for the year preceding termination of employment, earned and unpaid base salary and unreimbursed business expenses. In the event of a termination of the named executive officer’s employment by the Companywithout cause or resignation by the executivefor good reason within 12 months following achange of control(each, as defined in the applicable agreement), the named executives officer would be entitled to the severance described in the preceding sentence, except that the amount described in clause (ii) would be the full bonus amount (i.e., not pro rated for the partial year). In addition, a change of control of the Company would result in the acceleration of the vesting of certain unvested equity awards under our plans in certain circumstances, as described under “Long-Term Equity Incentive Awards” above.

In 2018, the Compensation Committee, working with Pearl Meyer, evaluated our executive compensation practices, including our severance arrangements in comparison to our peer group of public companies and the salary survey information referenced above. The Compensation Committee then recommended, and the Board subsequently authorized, management to implement, modifications to our severance arrangements, including for our current named executive officers. Effective as of January 25, 2019, these modifications have been implemented and apply to our President and Chief Executive Officer and her direct reports at the Senior Vice President level and above, including Mr. Marshall, Mr. Duffy and Dr. Orlandi. In exchange for being bound by certain restrictive covenants and providing a release and waiver in favor of the Company, in the event of a terminationwithout cause or resignation forgood reason, these new arrangements provide for the following severance payments and benefits: (i): one times annual base salary, plus a prorated portion of the target annual bonus in effect on the date of separation and an amount equal to the Company’s portion of COBRA premiums for up to 12 months following such termination of employment, in the event that the senior executiveexecutive’s employment is terminatedwithout causeor the executive resigns forgood reasonother than after achange of control; and (ii)

|

| • | | “Double Trigger” Change of Control: two times annual base salary, plus two times the full-year target annual bonus in effect on the date of separationtermination and an amount equal to the Company’s portion of COBRA premiums for 24 months following such termination of employment, in the event that the senior executiveexecutive’s employment is terminatedwithout causeor the executive resigns forgood reasonwithin 12 months of achange of control, with all unvested stock options and other equity-based awards also vesting in full (with performance-based equity awards vesting at target levels of achievement). The table below quantifies the amounts that would have become payable under each named executive officer’s employment agreement and equity award agreements if, on December 31, 2018, a change of control had been consummated and the named executive officer’s employment was terminated without cause or the named executive resigned for good reason under the agreements in place on January 25, 2019, as

|

The table below quantifies the amounts that would have become payable under each NEO’s employment agreement and equity award agreements if, on December 31, 2020, a change of control had been consummated and the NEO’s employment had been terminated without cause or the NEO resigned for good reason under the severance arrangements described above. Due to the number of factors that affect the nature and amount of any benefits provided upon the events discussed above, any actual amounts paid may be different. Factors that could affect these amounts include the timing during the year of any such event, the cost of benefits, the NEO’s base salary and our stock price. | | | | | | | | | | | | | | | | | | | Name and

Principal Position | | Payments for Termination

not related to Change in Control | | Payments for Termination

related to Change in Control | | | Cash

Severance ($) | | Total

Benefits(1) ($) | | Total Value ($) | | Cash

Severance ($) | | Value of

Accelerated

Equity(2) ($) | | Total

Benefits ($) | | Total Value

($) | | | | | | | | | | Mary Anne Heino President and Chief Executive Officer | | $1,500,025

| | $33,767

| | $1,533,793

| | $3,000,051

| | $4,082,277

| | $67,535

| | $7,149,863

| | | | | | | | | | Robert Marshall Chief Financial Officer | | $675,710

| | $28,404

| | $704,114

| | $1,351,420

| | $994,537

| | $56,808

| | $2,402,765

| | | | | | | | | | John Bolla Chief Operations Officer | | $535,050

| | $28,404

| | $563,454

| | $1,070,100

| | $707,673

| | $56,808

| | $1,834,581

| | | | | | | | | | Michael P. Duffy Senior Vice President, Law and Public Policy and General Counsel | | $647,618 | | $33,767 | | $681,386 | | $1,295,237 | | $801,198 | | $67,535 | | $2,163,970 | | | | | | | | | | Dr. Istvan Molnar Chief Medical Officer | | $600,000

| | $487

| | $600,487

| | $1,200,000

| | $391,210

| | $974

| | $1,592,184

|

| (1) | Total Benefits represent the Company-paid portion of COBRA. |

| (3) | Amounts in the ‘‘Value of Accelerated Equity” column represent the value of the number of factors that affecteach NEO’s performance and service-based RSUs, the nature and amount of any benefits provided upon the events discussed above, any actual amounts paid may be different. Factors that could affect these amounts include the timing during the year of any such event, the cost of benefits, the named executive officer’s base salary and our stock price. | | | | | | | | | | | | | | | | | Name | | Current

Salary

($) | | | Additional

Amount Total

($) | | | Benefits

($) | | | COC Total

($) | | Mary Anne Heino(1) | | | 675,000 | | | | 8,735,199 | | | | 28,247 | | | | 9,438,446 | | Robert J. Marshall, Jr.(2) | | | 405,000 | | | | 1,549,147 | | | | 28,247 | | | | 1,982,394 | | Michael Duffy(3) | | | 407,000 | | | | 2,591,574 | | | | 28,247 | | | | 3,026,821 | | Cesare Orlandi(4) | | | 418,000 | | | | 2,100,614 | | | | 19,892 | | | | 2,538,506 | |

(1) | The Additional Amount for Ms. Heino consists of (i) $1,822,500 in cash severance and (ii) the acceleration of RSAs and PSAs having a market value (based on a closing stock price of $15.65 as of December 31, 2018) of $6,912,699.

|

(2) | The Additional Amount for Mr. Marshall consists of (i) $850,500 in cash severance and (ii) the acceleration of RSAs and PSAs having a market value (based on a closing stock price of $15.65 as of December 31, 2018) of $698,647

|

(3) | The Additional Amount for Mr. Duffy consists of (i) $814,000 in cash severance, (ii) the acceleration of RSAs and PSAs having a market value (based on a closing stock price of $15.65 as of December 31, 2018) of $1,777,574.

|

(4) | The Additional Amount for Dr. Orlandi consists of (i) $836,000 in cash severance, and (ii) the acceleration of RSAs and PSAs having a market value (based on a closing stock price of $15.65 as of December 31, 2018) of $1,264,614.

|

No compensation is due to our named executive officers upon a change of control that is not followed by a qualifying termination of employment, other than as described above or as required by applicable law.

In addition, each of the severance arrangements with our named executive officers provides for a modifiedcut-back in the event that adverse tax consequences are imposed on the receipt of parachute payments by the named executive officer pursuant to Sections 280G and 4999 of the Internal Revenue Code of 1986, as amended (the “Code”). If any payments or benefits from the Company in the nature of compensation that are paid to or for the named executive officer’s benefit, whether paid or payable pursuant to his or her employment agreement or otherwise (each, a “Payment”), would subject the named executive officer to the excise tax under Section 4999 of the Code, then the Payments will be reduced to the greatest amount of the Payments that can be paid that would not result in the imposition of the excise tax (the “Reduced Amount”). However, if the amount of the Payments the named executive officer would receive after payment of all applicable taxes, including any excise taxes, is greater than the Reduced Amount, then no such reduction will occur.

Separation Agreement with Mr. Crowley

In connection with his separation from the Company in September 2018, Mr. Crowley entered into a separation agreement with the Company under which Mr. Crowley received (i) a cash severance payment of $656,550, representing his annual base salary, target annual bonus and the portion of his cash long-term incentive plan award that had been achieved, (ii) reimbursement for COBRA premiums and up to $25,000 of outplacement benefits for up to twelve months following his separation date, and (iii) accelerated vesting of 40,838 unvested RSAs, subject to transfer restrictions throughwhich would have accelerated as of December 31, 2020, calculated by multiplying the original vesting datesnumber of such awards or an earlier change in control, in addition to any amounts requiredaccelerated RSUs by law or the terms of the Company’s policies and benefit plans. The separation agreement included a confirmation of the restrictive covenants to which Mr. Crowley was subject, includingconfidentiality, non-competition, non-solicitation, no-hire and invention assignment covenants, and a release of claims in favor of the Company, its affiliates and certain other persons.

Stock Ownership and Retention Guidelines

In February 2019, the Compensation Committee recommended, and the Board approved and adopted, Stock Ownership and Retention Guidelines (“Guidelines”). Under these Guidelines:

Our CEO and the executive officers who directly report to her are required to acquire and hold (vested) shares$13.49 (the closing price of our common stock in an aggregate value at least equal to a specified multiple of his or her base salary, as determined by his or her position.on December 31, 2020). The multiple ranges from one times base salary for certain of our executive officers, to three times base salary for our CEO.

Additionally, ournon-employee directors are required to acquire and hold (vested) shares of our common stock in an aggregate amount at least equal to three times their annual Board cash retainer.

Until a director or executive officer achieves his or her required ownership level, he or she is required to retain 50% of allafter-tax Shares issued upon (i) exerciseacceleration of any vested Companyperformance-based equity would vest at the target amount. No NEOs have any unvested stock option award (calculated on a net exercise basis) or (ii) the vestingoptions as of any other Company stock incentive award (such as the RSAs, RSUs, PSAs and PSUs described above). These retention requirements apply to new equity award grants commencing in 2019.

Our executive officers andnon-employee directors are required to comply with the Guidelines within five years of when the Guidelines apply to them. As of February 26, 2019, Messrs. Markison, Clemmer and Leno, Ms. McHugh and Drs. Robertson and Schaffer, and Ms. Heino and Mr. Duffy each had already achieved the requirements under the stock ownership guidelines.

A copy of our Stock Ownership and Retention Guidelines is available on the Corporate Governance section of our Investor Relations website at http://investor.lantheus.com.

DIRECTOR COMPENSATION

For 2018, each of ournon-employee directors was eligible to receive the following annual compensation in cash (which is paid quarterly in advance and prorated for partial periods of service) for services as a director and, as applicable, Board committee member:

each director receives an annual fee of $50,000, and the Chairperson of the Board receives an additional annual fee of $62,500;

each member of the Audit Committee receives an annual fee of $10,000, and the Chairperson of the Audit Committee instead receives an annual fee of $20,000;

each member of the Compensation Committee receives an annual fee of $7,500, and the Chairperson of the Compensation Committee instead receives an annual fee of $15,000;

each member of the Nominating and Governance Committee receives an annual fee of $4,000, and the Chairperson of the Nominating and Governance Committee instead receives an annual fee of $10,000; and

each member of the Financing and Strategy Committee receives an annual fee of $5,000, and the Chairperson of the Financing and Strategy Committee instead receives an annual fee of $7,500.

The Compensation Committee periodically engages Pearl Meyer to review the Company’s outside director compensation program. The review covers the levels of cash and equity retainers that are provided to outside directors, as well as the overall structure of the program, against the same peer group of public companies used for executive compensation benchmarking purposes. The independent consultant makes recommendations to the Compensation Committee for consideration, and the Compensation Committee subsequently recommends any changes to the outside director compensation program for the Board’s approval. After reviewing the results of a compensation study prepared by Pearl Meyer, the Compensation Committee recommended, and the Board approved, an increase to the annual fee for each member of the Nominating and Governance Committee to $5,000 for 2019.

Directors who are employees of the Company do not receive separate or additional compensation for their services as directors or committee members.

In 2018, eachnon-employee director was granted 7,911 RSAs under our 2015 Equity Incentive Plan. These 2018 awards vested in full on March 5, 2019. On February 26, 2019, eachnon-employee director was granted 5,353 RSUs under our 2015 Equity Incentive Plan. These 2019 annual equity awards will vest in full on February 26, 2020, generally subject to continued service through that date.

All directors are subject to the Company’s Stock Ownership and Retention Guidelines described above.

Non-employee directors are also entitled to reimbursement forout-of-pocket expenses incurred in connection with rendering those services for so long as they serve as directors.

The following table shows compensation paid to the individuals who served as ournon-employee directors in 2018:

| | | | | | | | | | | | | | | | | | | | | Name(1) | | Fees Earned or

Paid in Cash

($) | | | Stock Awards(2)

($) | | | Option

Awards ($) | | | All Other

Compensation

($) | | | Total

($) | | Brian Markison(3) | | | 116,854 | | | | 125,000 | | | | — | | | | — | | | | 241,854 | | James C. Clemmer(4) | | | 67,500 | | | | 125,000 | | | | — | | | | — | | | | 192,500 | | Samuel Leno(5) | | | 74,213 | | | | 125,000 | | | | — | | | | — | | | | 199,213 | | Julie McHugh(6) | | | 65,000 | | | | 125,000 | | | | — | | | | — | | | | 190,000 | | Gary Pruden(7) | | | 54,775 | | | | 125,000 | | | | — | | | | — | | | | 179,775 | | Kenneth Pucel(8) | | | 48,455 | | | | 125,000 | | | | — | | | | — | | | | 173,455 | | Dr. Frederick Robertson(9) | | | 70,000 | | | | 125,000 | | | | — | | | | — | | | | 195,000 | | Dr. Derace Schaffer(10) | | | 62,343 | | | | 125,000 | | | | — | | | | — | | | | 187,343 | | Dr. James Thrall(11) | | | 46,348 | | | | 125,000 | | | | — | | | | — | | | | 171,348 | |

(1) | Ms. Heino does not receive any additional compensation for her service as a director and is not listed in the table above. For information regarding Ms. Heino’s 2018 executive compensation, see “Summary Compensation Table” above.December 31, 2020.

|

(2) | The amounts in the stock awards column reflect the aggregate grant date fair value, calculated in accordance with FASB ASC Topic 718, of RSAs, excluding the effect of estimated forfeitures. The aggregate grant date fair value of RSAs is measured based on the closing fair market value of the our common stock on the date of grant, multiplied by the number of Shares subject to the award granted, for each RSA grant made during the year. This grant date fair value does not necessarily correspond to the actual value that will ultimately be realized by each director, which will likely vary based on a number of factors, including our financial performance, stock price fluctuations and applicable vesting.

No compensation is due to our NEOs upon a change of control that is not followed by a qualifying termination of employment, other than as described above or as required by applicable law. In addition, each of the severance arrangements with our NEOs provides for a modified cut-back in the event that adverse tax consequences are imposed on the receipt of parachute payments by the named executive officer pursuant to Sections 280G and 4999 of the Internal Revenue Code of 1986, as amended (the “Code”). If any payments or benefits from the Company in the nature of compensation that are paid to or for the named executive officer’s benefit, whether paid or payable pursuant to her or his employment agreement or otherwise (each, a “Payment”), would subject the named executive officer to the excise tax under Section 4999 of the Code, then the Payments will be reduced to the greatest amount of the Payments that can be paid that would not result in the imposition of the excise tax (the “Reduced Amount”). However, if the amount of the Payments the named executive officer would receive after payment of all applicable taxes, including any excise taxes, is greater than the Reduced Amount, then no such reduction will occur. CEO Pay Ratio Under SEC rules, we are required to disclose the ratio of our CEO’s annual total compensation to the median of the annual total compensation of all our other employees. We determined that the 2020 median of the annual total compensation of all our employees who were employed as of December 31, 2020, other than our CEO, Ms. Heino, was $116,952; Ms. Heino’s 2020 annual total compensation was $4,326,357 (as reported on our Summary Compensation Table). Based on the foregoing, our estimate of the ratio of the annual total compensation of our CEO to the median annual total compensation of all our other employees was 37 to 1. To identify the median compensated employee, we used Box 5 W-2 data for all individuals (with the exception of Ms. Heino) employed on December 31, 2020, annualizing such data for those individuals employed less than the full year of 2020. As of December 31, 2020, our total population excluding our CEO consisted of 594 employees located in the United States, Canada and Sweden. Pursuant to SEC rules, we excluded the 12 Canadian employees and 14 Swedish employees in identifying our median paid employee. After applying this exemption, the employee population excluding the CEO used for purposes of identifying the median employee consisted of 568 employees. We then calculated the annual compensation of the median employee using the same methodology used to calculate Ms. Heino’s compensation for the Summary Compensation Table. We believe that the pay ratio reported above is a reasonable estimate calculated in a manner consistent with SEC rules based on our internal records and the methodology described above. The SEC rules for identifying the median compensated employee and calculating the pay ratio based on that employee’s annual total compensation allow companies to adopt a variety of methodologies, to apply certain exclusions, and to make reasonable estimates and assumptions that reflect their employee populations and compensation practices. Therefore, our ratio may not be comparable to the ratios disclosed by other companies based on a number of factors, including differences in employee populations, different geographic distributions of employees, and the nature of the companies’ businesses. |

(3) | On March 5, 2018, Mr. Markison was granted 7,911 RSAs. As of December 31, 2018, Mr. Markison held (a) 7,911 unvested RSAs and (b) outstanding options to purchase 58,913 Shares, of which options to purchase 58,913 Shares were vested.

|

(4) | On March 5, 2018, Mr. Clemmer was granted 7,911 RSAs. As of December 31, 2018, Mr. Clemmer held (a) 7,911 unvested RSAs and (b) outstanding options to purchase 6,993 Shares, of which options to purchase 6,993 Shares were vested.

|

(5) | On March 5, 2018, Mr. Leno was granted 7,911 RSAs. As of December 31, 2018, Mr. Leno held (a) 7,911 unvested RSAs and (b) outstanding options to purchase 33,871 Shares, of which options to purchase 33,871 Shares were vested.

|

(6) | On March 5, 2018, Ms. McHugh was granted 7,911 RSAs, respectively. As of December 31, 2018, Ms. McHugh held 7,911 unvested RSAs.

|

(7) | On March 5, 2018, Mr. Pruden was granted 7,911 RSAs. As of December 31, 2018, Mr. Pruden held 7,911 unvested RSAs.

|

(8) | On March 5, 2018, Mr. Pucel was granted 7,911 RSAs. As of December 31, 2018, Mr. Pucel held 7,911 unvested RSAs.

|

(9) | On March 5, 2018, Dr. Robertson was granted 7,911 RSAs. As of December 31, 2018, Dr. Robertson held 7,911 unvested RSAs.

|

(10) | On March 5, 2018, Dr. Schaffer was granted 7,911 RSAs. As of December 31, 2018, Dr. Schaffer held 7,911 unvested RSAs.

|

(11) | On March 5, 2018, Dr. Thrall was granted 7,911 RSAs. As of December 31, 2018, Dr. Thrall held 7,911 unvested RSAs.

|

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT The following table sets forth information regarding the beneficial ownership of our common stock held by (i) each of our directors, (ii) each of our named executive officers, (iii) our directors and executive officers as a group and (iv) each person known to us to beneficially own more than 5% of our common stock. For our directors and officers, the information is as of the Record Date, March 8, 2021. For other stockholders who own more than 5% of our common stock, the information is as of the most recent Schedule 13G filed by each of those stockholders with the SEC. Beneficial ownership of Shares is determined under rules of the SEC and generally includes any Shares over which a person exercises sole or shared voting or investment power. Except as noted by footnote, and subject to community property laws where applicable, we believe based on the information provided to us that the persons and entities named in the table below have sole voting and investment power with respect to all Shares shown as beneficially owned by them. Percentage of beneficial ownership is calculated in part based on 67,412,311 Shares outstanding as of March 8, 2021. Shares subject to RSAs or RSUs that are currently vested or that will vest within 60 days of March 8, 2021, and stock options currently exercisable or exercisable within 60 days of the date of this proxy statement, are deemed to be outstanding and beneficially owned by the person holding those RSAs, RSUs and options for the purposes of computing the percentage of beneficial ownership of that person and any group of which that person is a member, but are not deemed outstanding for the purpose of computing the percentage of beneficial ownership for any other person. Unless otherwise indicated, the address for each holder listed below is c/o Lantheus Holdings, Inc., 331 Treble Cove Road, North Billerica, MA 01862. | | | | | | | | | Name of Beneficial Owner | | Number of Shares

of Common Stock

Beneficially Owned | | Percentage Ownership | | | | | Directors and Named Executive Officers | | | | | | | | | Brian Markison(1) | | 94,557 | | * | | | | | Mary Anne Heino(2) | | 428,307 | | * | | | | | Gérard Ber(3) | | 32,981 | | * | | | | | Samuel Leno(4) | | 77,338 | | * | | | | | Heinz Mäusli(5) | | 25,481 | | * | | | | | Julie McHugh(6) | | 23,849 | | * | | | | | Gary Pruden(7) | | 18,167 | | * | | | | | Dr. Frederick Robertson(8) | | 48,497 | | * | | | | | Dr. James Thrall(9) | | 17,859 | | * | | | | | Robert J. Marshall Jr.(10) | | 12,381 | | * | | | | | John Bolla(11) | | 12,192 | | * | | | | | Michael P. Duffy(12) | | 79,761 | | * | | | | | Dr. Istvan Molnar(13) | | 5,639 | | * | | | | | All Directors and Executive Officers as a Group (17 persons)(14) | | 946,680 | | 1.4% |

| | | | | | | | | Name of Beneficial Owner | | Number of Shares

of Common Stock

Beneficially Owned | | Percentage Ownership | | | | | 5% Stockholders | | | | | | | | | BlackRock, Inc.(15) | | 10,291,302 | | 15.3% | | | | | Wellington Management Group LLP and affiliates(16) | | 10,143,349 | | 15.0% | | | | | Armistice Capital, LLC(17) | | 5,200,000 | | 7.7% | | | | | The Vanguard Group, Inc.(18) | | 3,830,155 | | 5.7% | | | | | T. Rowe Price Associates, Inc.(19) | | 3,768,073 | | 5.6% |

| * | Represents beneficial ownership of less than 1% of our common stockoutstanding Shares. |

| (1) | Includes 58,913 Shares issuable upon exercise of outstanding options that were exercisable within the 60-day period following March 8, 2021. Does not include 3,631 unvested RSUs held by (i) eachMr. Markison. |

| (2) | Includes 44,484 Shares issuable upon exercise of outstanding options that were exercisable within the 60-day period following March 8, 2021. Does not include 345,261 unvested RSUs and PSUs held by Ms. Heino. |

| (3) | Includes 17,481 Shares issuable upon exercise of outstanding options that were exercisable within the 60-day period following March 8, 2021. Does not include 7,787 unvested RSUs held by Mr. Ber. |

| (4) | Includes 33,871 Shares issuable upon exercise of outstanding options that were exercisable within the 60-day period following March 8, 2021. Does not include 2,317 unvested RSUs held by Mr. Leno. |

| (5) | Includes 17,481 Shares issuable upon exercise of outstanding options that were exercisable within the 60-day period following March 8, 2021. Does not include 8,211 unvested RSUs held by Mr. Mäusli. |

| (6) | Does not include 2,008 unvested RSUs held by Ms. McHugh. |

| (7) | Does not include 2,085 unvested RSUs held by Mr. Pruden. |

| (8) | Does not include 2,162 unvested RSUs held by Dr. Robertson. |

| (9) | Does not include 2,008 unvested RSUs held by Mr. Thrall. |

| (10) | Does not include 124,128 unvested RSAs, RSUs and PSUs held by Mr. Marshall. |

| (11) | Does not include 92,501 unvested RSAs, RSUs and PSUs held by Mr. Bolla. |

| (12) | Includes 24,911 Shares issuable upon exercise of outstanding options that were exercisable within the 60-day period following March 8, 2021. Does not include 62,122 unvested RSUs and PSUs held by Mr. Duffy. |

| (13) | Does not include 53,154 unvested RSUs held by Dr. Molnar. |

| (14) | Includes 213,244 Shares issuable upon exercise of outstanding options that were exercisable within the 60-day period following March 8, 2021. Does not include 919,289 unvested RSAs, RSUs and PSUs held by our directors (ii) each of our named executive officers, (iii) our directors and named executive officers as a group and (iv) each person knowngroup. |

| (15) | Based solely on Amendment No. 4 to us to beneficially own more than 5% of our common stock. For our directors and officers, the information is as of the Record Date, February 26, 2019. For other stockholders who own more than 5% of our common stock, the information is as of the most recent Schedule 13G filed on January 25, 2021 by each of those stockholders with the SEC. Beneficial ownership of Shares is determined under rules of the SEC and generally includes any Shares over which a person exercises sole or shared voting or investment power. Except as noted by footnote, and subject to community property laws where applicable, we believe based on the information provided to usBlackRock, Inc. In that the persons and entities named in the table below havefiling, BlackRock, Inc. reports sole voting and investment power with respect to all10,224,809 Shares shownand sole dispositive power with respect to 10,291,302 Shares, and lists its address as beneficially owned55 E. 52nd Street, New York, New York 10055.

|

| (16) | Based solely on the Amendment No. 1 to Schedule 13G filed on February 3, 2021 and February 4, 2021, by them.Wellington Trust Company, NA and Wellington Management Group LLP, respectively. In that filing Wellington Management Group LLP and affiliates reports shared voting power with respect to 9,699,399 Shares and shared dispositive power with respect to 10,143,349 Shares and lists its address as 280 Congress Street, Boston, MA 02210. |

| (17) | Percentage of beneficial ownership is calculated in part basedBased solely on 38,628,501the Amendment No. 1 to Schedule 13G filed on February 16, 2021 by Armistice Capital, LLC. In that filing Armistice Capital, LLC reports shared voting power with respect to 5,200,000 Shares outstandingand shared dispositive power with respect to 5,200,000 Shares and lists its address as of510 Madison Ave., New York , NY 10022.

|

| (18) | Based solely on the Amendment No. 3 to Schedule 13G filed on February 26, 2019.10, 2021 by The Vanguard Group, Inc. In that filing The Vanguard Group, Inc. reports sole dispositive power with respect to 3,625,485 Shares, subjectshared voting power with respect to RSAs that are currently vested or that will vest within 60 days of the date of this proxy statement,152,923 Shares and stock options currently exercisable or exercisable within 60 days of the date of this proxy statement, are deemedshared dispositive power with respect to be outstanding and beneficially owned by the person holding those RSAs and options for the purposes of computing the percentage of beneficial ownership of that person and any group of which that person is a member, but are not deemed outstanding for the purpose of computing the percentage of beneficial ownership for any other person. Unless otherwise indicated, the address for each holder listed below is c/o Lantheus Holdings, Inc., 331 Treble Cove Road, North Billerica, MA 01862.

| | | | | | | | | | | Name of Beneficial Owner | | Number of Shares

of Common Stock

Beneficially Owned | | Percentage Ownership | Directors and Named Executive Officers | | | | | | | | | | | Brian Markison(1) | | | | 151,027 | | | | | * | | James Clemmer(1) | | | | 55,627 | | | | | * | | Samuel Leno(1) | | | | 82,048 | | | | | * | | Julie McHugh(1) | | | | 14,752 | | | | | * | | Dr. Frederick Robertson(1) | | | | 41,641 | | | | | * | | Dr. Derace Schaffer(1) | | | | 51,641 | | | | | * | | Dr. James Thrall(1) | | | | 7,911 | | | | | * | | Gary Pruden(1) | | | | 7,911 | | | | | * | | Kenneth Pucel(1) | | | | 7,911 | | | | | * | | Mary Anne Heino(2) | | | | 354,628 | | | | | * | | Michael Duffy(3) | | | | 98,598 | | | | | * | | Cesare Orlandi(4) | | | | 54,218 | | | | | * | | Robert J. Marshall Jr.(5) | | | | — | | | | | * | | John W. Crowley(6) | | | | 64,057 | | | | | * | | All Directors and Named Executive Officers as a Group (14 persons)(7) | | | | 991,970 | | | | | 2.6 | % | 5% Stockholders | | | | | | | | | | | Black Rock, Inc.(8) | | | | 5,540,296 | | | | | 14.4 | % | Wellington Management Co. LLP(9) | | | | 2,674,989 | | | | | 6.9 | % | The Vanguard Group(10) | | | | 2,362,948 | | | | | 6.1 | % |

* | Represents beneficial ownership of less than 1% of our outstanding Shares.

|

(1) | Does not include 5,353 unvested RSUs held by each Director.

|

(2) | Does not include 399,351 unvested RSAs, RSUs and PSAs held by Ms. Heino.

|

(3) | Does not include 90,683 unvested RSAs, RSUs and PSAs held by Mr. Duffy.

|

(4) | Does not include 68,483 unvested RSAs, RSUs and PSAs held by Dr. Orlandi.

|

(5) | Does not include 64,588 unvested RSAs, RSUs and PSAs held by Mr. Marshall.

|

(6) | Based on shares held by Mr. Crowley upon separation with the Company on September 28, 2018.

|

(7) | Does not include 671,282 unvested RSAs, RSUs and PSAs held by our directors and named executive officers as a group.

|

(8) | Based solely on Amendment No. 1 to Schedule 13G filed on January 31, 2019 by Blackrock, Inc. In that filing, Blackrock, Inc. reports sole voting power with respect to 5,464,971204,670 Shares and sole dispositive power with respect to 5,540,296 Shares, and reports that not more than 5% of Shares is owned by any one client subject to the investment advice of Blackrock, Inc. Also in that filing, Blackrock, Inc. lists its address as 55 E. 52nd Street, New York, New York 10055.

|

(9) | Based solely on Amendment No. 3 to Schedule 13G filed on February 12, 2019 by Wellington Management Group LLP, Wellington Group Holdings LLP, Wellington Investment Advisors Holdings LLP and Wellington Management Company LLP (collectively, “Wellington”). In that filing, (i) Wellington Management Group LLP, Wellington Group Holdings LLP and Wellington Investment Advisors Holdings LLP each report shared voting power with respect to 2,674,989 Shares and shared dispositive power with respect to 2,674,989 Shares and (ii) Wellington Management Company LLP reports shared voting power with respect to 2,616,506 Shares and shared dispositive power with respect to 2,616,506 Shares. In that filing, Wellington also reports that (a) all of these Shares are owned of record by clients of one or more of the following of its investment advisors: Wellington Management Company LLP, Wellington Management Canada LLC, Wellington Management Singapore Pte Ltd, Wellington Management Hong Kong Ltd, Wellington Management International Ltd, Wellington Management Japan Pte Ltd and Wellington Management Australia Pty Ltd (collectively, the “Wellington Investment Advisers”), (b) none of those clients owns more than 5% of Shares, except for Wellington Trust Company, NA, (c) Wellington Management Group LLP is the parent holding company of certain holding companies and the Wellington Investment Advisers, (d) Wellington Investment Advisors Holdings LLP controls directly, or indirectly through Wellington Management Global Holdings, Ltd., the Wellington Investment Advisers, (e) Wellington Investment Advisors Holdings LLP is owned by Wellington Group Holdings LLP and (f) Wellington Group Holdings LLP is owned by Wellington Management Group LLP. Also in that filing, Wellington lists its address as c/o Wellington Management Company LLP, 280 Congress Street, Boston, MA 02210.

|

(10) | Based solely on a Schedule 13G filed on February 12, 2019 by The Vanguard Group. In that filing, The Vanguard Group reports sole voting power with respect to 75,084 Shares, shared voting power with respect to 2,200 Shares, shared dispositive power with respect to 72,236 Shares and sole dispositive power with respect to 2,290,712 Shares, and reports that not more than 5% of Shares is owned by any one client subject to the investment advice of The Vanguard Group. Also in that filing, The Vanguard Group lists its address as The Vanguard Group, 100 Vanguard Blvd., Malvern, PA 19355.

|

| (19) | SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s directors, certain executive officers and persons who beneficially own more than 10% of the Company’s Shares, to file reports of beneficial ownership and reports of changes in beneficial ownership with the SEC. These persons are required by SEC regulations to furnish the Company with copies of all Section 16(a) reports that they file. We assist our directors and executive officers with their Section 16(a) filings. Based solely on a review ofthe Amendment No. 1 to Schedule 13G filed on February 16, 2021 by T. Rowe Price Associates, Inc. In that filing, T. Rowe Price Associates, Inc. reports filed with the SEC and written representations from directors and executive officers, we believe that all required reports under Section 16(a)sole voting power with respect to those persons were timely filed during 2018.

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

This section describes certain relationships763,545 Shares and related person transactions between us or our subsidiaries, on the one hand, and our directors, director nominees, executive officers, holders of more than 5% of our voting securities and certain related persons of any of the foregoing, on the other hand, since January 1, 2018.

Indemnification Agreements

We have entered into indemnification agreements with each of our directors and executive officers. These agreements, among other things, require us to indemnify each director and executive officer to the fullest extent permitted by applicable law, including indemnification of expenses, such as attorneys’ fees, judgments, penalties, fines and settlement amounts, actually and reasonably incurred by the director or executive officer in any action or proceeding, including, without limitation, all liability arising out of negligence or active or passive wrongdoing by that officer or director, in any action or proceeding by or in right of us, arising out of the person’s services as a director or executive officer, in each case, subject to certain exceptions. At present, we are not aware of any pending or threatened litigation or proceeding involving any of our directors, executive officers, employees or agents in which indemnification would be required or permitted. We believe these indemnification agreements are necessary to attract and retain qualified persons as directors and executive officers.

Policies for Approval of Related Person Transactions

We have a written policy relating to the approval of related person transactions pursuant to which the Audit Committee reviews and approves or ratifies all relationships and related person transactions between us and (i) our directors, director nominees and executive officers, (ii) any 5% record or beneficial owner of Shares or (iii) any immediate family member of any person specified in (i) or (ii) above. Management, under the oversight of the Audit Committee, is primarily responsible for the development and implementation of processes and controls to obtain information from our directors and executive officerssole dispositive power with respect to 3,768,073 Shares, and lists its address as 100 E. Pratt Street, Baltimore, MD 21202.

|

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS Related Person Transactions This section describes certain relationships and related person transactions between us or our subsidiaries, on the one hand, and our directors, director nominees, executive officers, holders of more than 5% of our voting securities and certain related persons of any of the foregoing, on the other hand, since January 1, 2020. Indemnification Agreements We have entered into indemnification agreements with each of our directors and executive officers. These agreements, among other things, require us to indemnify each director and executive officer to the fullest extent permitted by applicable law, including indemnification of expenses, such as attorneys’ fees, judgments, penalties, fines and settlement amounts, actually and reasonably incurred by the director or executive officer in any action or proceeding, including, without limitation, all liability arising out of negligence or active or passive wrongdoing by that officer or director, in any action or proceeding by or in right of us, arising out of the person’s services as a director or executive officer, in each case, subject to certain exceptions. At present, we are not aware of any pending or threatened litigation or proceeding involving any of our directors, executive officers, employees or agents in which indemnification would be required or permitted. We believe these indemnification agreements are necessary to attract and retain qualified persons as directors and executive officers. Policies for Approval of Related Person Transactions We have a written policy relating to the approval of related person transactions pursuant to which the Audit Committee reviews and approves or ratifies all relationships and related person transactions between us and (i) our directors, director nominees and executive officers, (ii) any 5% record or beneficial owner of Shares or (iii) any immediate family member of any person specified in (i) or (ii) above. Management, under the oversight of the Audit Committee, is primarily responsible for the development and implementation of processes and controls to obtain information from our directors and executive officers with respect to related person transactions, and the Audit Committee is primarily responsible for determining, based on the facts and circumstances, whether we have, or a related person has, a direct or indirect material interest in the transaction. As set forth in our related person transaction policy, in the course of its review and approval or ratification of a related person transaction, the Audit Committee will consider: the nature of the related person’s interest in the transaction;

the availability of other sources of comparable products or services;

the material terms of the transaction, including, without limitation, the amount and type of transaction; and

the importance of the transaction to us.

Any member of the Audit Committee who is a related person with respect to a transaction under review will not be permitted to participate in the approval or ratification of the transaction. However, that member of the Audit Committee will provide all material information concerning the transaction to the Audit Committee.

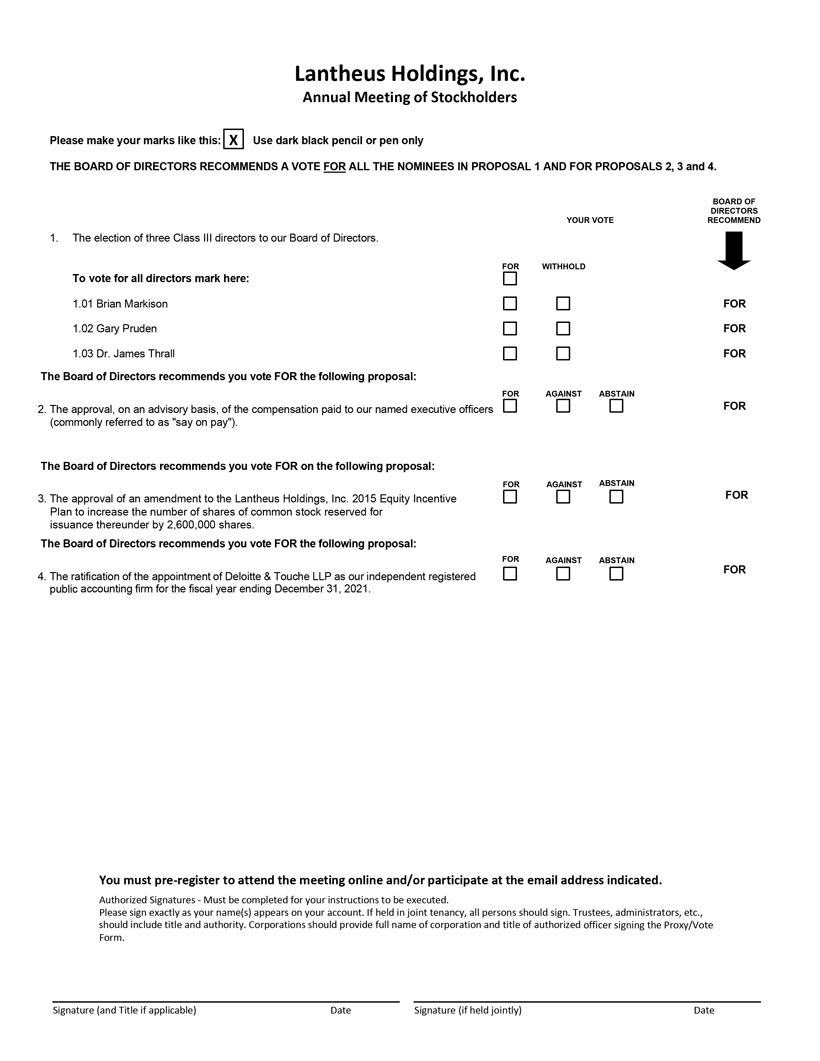

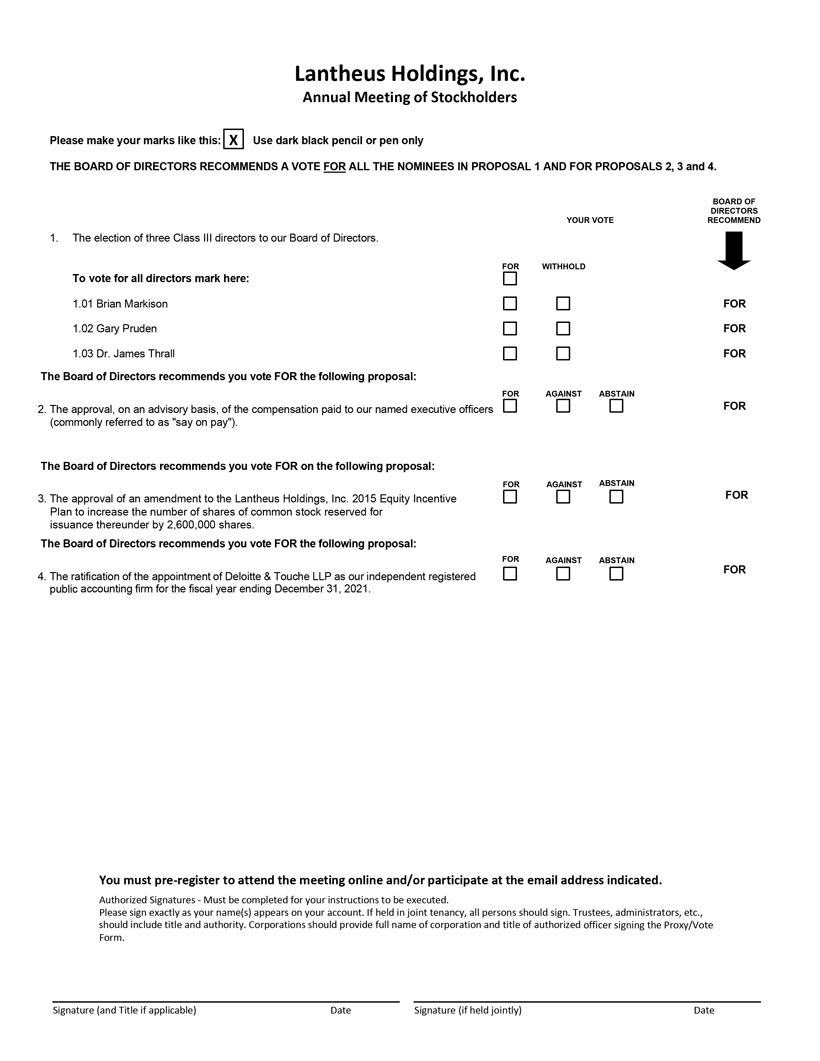

PROPOSAL 2:

Amendment to 2015 Equity Incentive Plan

We are seeking stockholder approval to amend the Lantheus Holdings, Inc. 2015 Equity Incentive Plan (as amended to date, the “2015 Equity Incentive Plan”) to increase the number of Shares reserved for issuance under the 2015 Equity Incentive Plan by an additional 825,000 Shares. We are not seeking stockholder approval of any other changes to the 2015 Equity Incentive Plan.

We believe that our continuing ability to offer equity incentive awards under the 2015 Equity Incentive Plan is critical to our ability to attract, motivate and retain key individuals who are critical to our long term success, particularly as we grow and in light of the highly-competitive market for talent in which we operate.

The Board has determined that it is in the best interests of the Company and its stockholders to approve this proposal. As such, the Board has approved the amendment to the 2015 Equity Incentive Plan to increase the number of Shares available thereunder, subject to stockholder approval, and recommends that stockholders vote in favor of this proposal at the Annual Meeting. Stockholder approval of this proposal requires the affirmative vote of a majority of the outstanding Shares that are present in person or by proxy and entitled to vote on the proposal at the Annual Meeting.

If stockholders approve this proposal, the amendment to the 2015 Equity Incentive Plan to increase the number of Shares available thereunder will become effective as of the date of stockholder approval. If stockholders do not approve this proposal, the amendment to 2015 Equity Incentive Plan will not take effect and our 2015 Equity Incentive Plan will continue to be administered in its current form. Our executive officers and directors have an interest in this proposal by virtue of their being eligible to receive equity awards under the 2015 Equity Incentive Plan. The remainder of this discussion, when referring to the 2015 Equity Incentive Plan, refers to the amended 2015 Equity Incentive Plan as if this proposal was approved by our stockholders, unless otherwise specified or the context otherwise references the 2015 Equity Incentive Plan prior to this proposed amendment.

Background

The 2015 Equity Incentive Plan was initially adopted in June 2015 with an initial Share reserve of 2,415,277 Shares, which was increased by 2,140,000 Shares in April 2016 and by an additional 1,200,000 Shares in April 2017 following Board and stockholder approvals. In February 2019, in order to implement additional best corporate governance and compensation practices, our Compensation Committee approved another amendment to the 2015 Equity Incentive Plan to:

prohibit the payment of dividends or other distributions accruing on unvested equity awards prior to the time the underlying award vests; and

provide a minimum12-month period to elapse before any portion of unvested equity awards can vest (subject to certain exceptions, including for a death, disability, change of control, terminations of employment in connection with a change of control and otherwise for up to 5% of the Shares reserved for issuance).

The February 2019 amendment (a copy of which is included on page A-27 of Appendix A), which applies to all new equity awards granted after its adoption, is currently effective and not subject to stockholder approval.

Any Shares subject to outstanding awards under the 2015 Equity Incentive Plan that expire or are otherwise forfeited to the Company (other than Shares withheld by the Company to satisfy exercise price or tax withholding payment obligations) become available again for future grant under the 2015 Equity Incentive Plan.

As of March 1, 2019, taking into account our expected 2019 grants, approximately 1,341,200 Shares remain available for grant under the 2015 Equity Incentive Plan. The Board believes that additional Shares are necessary to meet the Company’s currently anticipated equity compensation needs for approximately the next two years following the Annual Meeting. This estimate is based on a forecast that takes into account the anticipated rate of growth in hiring, an estimated range of our stock price over time and our historical forfeiture rates.

Reasons for Voting for the Proposal

Long-Term Equity is a Key Component of our Compensation Objective

Delivering competitive equity value to our management team is essential to attracting and retaining the quality of talent required for us to achieve our financial, operating and strategic objectives. We compete for this talent with a significant number of biotechnology, pharmaceutical and other life sciences companies in Massachusetts that offer substantial equity grant programs. We strongly believe that hiring and retaining key talent is very much in the interests of our stockholders.

Equity awards incentivize our employees to manage our business as owners, aligning their interests with the long-term interests of our stockholders. Equity awards, the value of which depend on our stock performance and which require continued service and/or performance over long periods of time before any value can be realized, help achieve these objectives and are a key element of our compensation program.

Equity awards allow us to preserve our cash resources.

We believe that, for investors, a combination of equity and cash compensation optimizes the Company’s valuation and properly incentivizes executives by linking their pay to Company performance.

If we do not obtain stockholder approval to increase the available pool, the Company anticipates that it will have an insufficient number of Shares to make equity-based compensation a meaningful part of our employees’ and officers’ overall compensation. As such, the Company believes its ability to retain and attract talented employees will be adversely affected.

Our Company is Committed to the Effective Utilization of Shares

The Compensation Committee has engaged Pearl Meyer, an independent compensation consulting firm, to assist us in our periodic evaluation of market competitive practices and optimal share utilization.

In February 2018, following consultation with Pearl Meyer, the Compensation Committee changed the performance metrics under our equity compensation program from specified revenue and adjusted EBITDA performance goals, to rTSR goals. This change was intended to better align management’s interests with the long-term interests of stockholders and to manage our limited share reserve under our 2015 Equity Incentive Plan, while taking into account competitive compensation practices.

In determining the amount of Share increase requested by this proposal, our Board considered the historical number of equity awards granted by the Company in the past three years, as described in the following table:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Year | | Stock

Options

Granted | | | Time-

Based

RSAs

Granted | | | PSAs

Granted

(at Target)(1) | | | PSAs

Earned | | | Total

Number

Of Shares

Granted | | | Weighted Average

Common Shares

Outstanding | | | Time-Based

RSAs

Granted

and PSAs

Earned

Share

Grant Rate | | | Total Share

Grant Rate | | 2018 | | | 0 | | | | 647,850 | | | | 206,896 | | | | 0 | | | | 854,746 | | | | 38,233,292 | | | | 1.69 | % | | | 2.24 | % | 2017 | | | 0 | | | | 395,146 | | | | 303,495 | | | | 0 | | | | 698,641 | | | | 37,276,366 | | | | 1.06 | % | | | 1.87 | % | 2016(2) | | | 0 | | | | 1,364,000 | | | | 0 | | | | 0 | | | | 1,364,000 | | | | 32,043,904 | | | | 4.26 | % | | | 4.26 | % | | | (1) Assuming full achievement of the Company’s performance goals, the maximum portion of the 2017 PSAs and 2018 PSAs that would vest is 120% and 200%, respectively, of the target number of PSAs. (2) Due to the Company’s low stock price in 2016, the Company needed to grant a relatively greater number of Shares to deliver a comparable value of equity awards to grantees. | |

Our 2015 Equity Incentive Plan is consistent with principles of good corporate governance

The Board believes that the 2015 Equity Incentive Plan will promote the interests of stockholders and is consistent with principles of good corporate governance, including:

| • | | No Evergreen Share Pool. The 2015 Equity Incentive Plan does not include an “evergreen” share pool that would increase the number of Shares available without stockholder approval.

|

the nature of the related person’s interest in the transaction; | • | | No Discounted Stock Options or SARs. All stock option and stock appreciation rights awards under the 2015 Equity Incentive Plan must have an exercise or base price that is not less than the fair market value of the underlying common stock on the date of grant.

|

the availability of other sources of comparable products or services; | • | | No Repricing. Other than in connection with a change of control or dilutive events, the 2015 Equity Incentive Plan prohibits any repricing of stock options or stock appreciation rights.

|

the material terms of the transaction, including, without limitation, the amount and type of transaction; and | • | | No Liberal Share Recycling. Shares underlying stock options and other awards issued under the 2015 Equity Incentive Plan will not be recycled into the Share pool if they are withheld in payment of the exercise price of the award or to satisfy tax withholding obligations in respect of the award.

the importance of the transaction to us. Any member of the Audit Committee who is a related person with respect to a transaction under review will not be permitted to participate in the approval or ratification of the transaction. However, that member of the Audit Committee will provide all material information concerning the transaction to the Audit Committee. PROPOSAL 4: RATIFICATION OF INDEPENDENT AUDITOR The Audit Committee has appointed Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending December 31, 2021. Although stockholder ratification of the appointment of Deloitte is not required by law, we are submitting the appointment to our stockholders for ratification as a matter of good corporate governance. Representatives of Deloitte are expected to attend the Annual Meeting, will have an opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions. Vote Required The ratification of the appointment of Deloitte requires the affirmative vote of a majority of the votes cast at the Annual Meeting. If stockholders do not ratify the appointment of Deloitte, then the Audit Committee will reconsider the appointment. Even if stockholders ratify the appointment of Deloitte, the Audit Committee retains the discretion to appoint a different independent auditor at any time if it determines that such a change would be in the best interests of the Company and its stockholders. Board of Directors’ Recommendation THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF DELOITTE AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2021 AND PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR OF SUCH APPROVAL, UNLESS A STOCKHOLDER INDICATES OTHERWISE ON THE PROXY. Deloitte Fees The following table presents aggregate fees billed to the Company for services rendered by Deloitte during the years ended December 31, 2020 and 2019: |

| • | | Minimum Vesting Periods. New awards under the 2015 Equity Incentive Plan are subject to a minimum12-month vesting period (subject to certain exceptions, including for a death, disability, change of control, terminations of employment in connection with a change of control and otherwise for up to 5% of the Shares reserved for issuance). | | | | | | | | | | | | | | | Year Ended December 31, | | | | | | | | | 2020 | | | 2019 | | | | | | Audit fees(1) | | $ | 1,835,900 | | | $ | 1,490,227 | | | | | | Audit-related fees | | | — | | | | — | | | | | | Tax fees(2) | | $ | 27,720 | | | | — | | | | | | All other fees(3) | | $ | 1,895 | | | $ | 1,895 | | | | | | Total | | $ | 1,865,515 | | | $ | 1,492,122 | |

|

| (1) | | • | | No Dividends on Unvested Awards. Dividend and dividend equivalents may not be paid on a current basis on unvested awards.

|

| • | | No Single-Trigger Change of Control Acceleration. Awards under the 2015 Equity Incentive Plan do not automatically accelerate upon a change of control (except for awards granted tonon-employee directors that haveone-year time-based vesting).

|

The 2015 Equity Incentive Plan Requires Additional SharesAudit fees are fees related to Meet our Forecasted Needs

We expect to grant equity awards representing approximately 631,000 Shares during 2019 (representing approximately 1.6% of our outstanding Shares as of March 1, 2019). We anticipate limited forfeitures and cancellations under the 2015 Equity Incentive Plan, consistent with our previous history. Forfeitures of awards under our previous equity plans cannot be credited to replenish the Shares available for grant under the 2015 Equity Plan.

As a result, the Board, based on the recommendation of the Compensation Committee, concluded that increasing the number of Shares available for issuance under our 2015 Equity Incentive Plan would provide the Company with the ability to undertake the flexible and balanced approach of using equity and cash compensation as needed to help us retain and motivate employees, which furthers stockholder interests.

Summary of the 2015 Equity Incentive Plan

The following is a summary of the material features of the 2015 Equity Incentive Plan. The summary is qualified in its entirety by the 2015 Equity Incentive Plan as set forth in Appendix A.

Administration

The 2015 Equity Incentive Plan is administered by the Compensation Committee or another committee of the Board, comprised of no fewer than two members of the Board who are appointed by the Board to administer the plan, or, subject to the limitations set forth in the 2015 Equity Incentive Plan, the Board (the appropriate body is referred to as the “Committee”). Subject to the limitations set forth in the 2015 Equity Incentive Plan, the Committee has the authority to determine the persons to whom awards are to be granted, prescribe the restrictions, terms and conditions of all awards, interpret the 2015 Equity Incentive Plan and adoptsub-plans and rules for the administration, interpretation and application of the 2015 Equity Incentive Plan.

Reservation of Shares

Subject to adjustments as described below, the maximum aggregate number of Shares that may be issued pursuant to awards granted under the 2015 Equity Incentive Plan, as amended, will be equal to 6,580,277 (including the 825,000 additional Shares proposed to be added pursuant to the amendment to the 2015 Equity Incentive Plan as set forth in this Proposal 2); provided, that no more than 20% of the Shares may be granted as incentive stock options within the meaning of Section 422 of the Code. Any Shares issued under the 2015 Equity Incentive Plan will consist of authorized and unissued Shares or treasury shares.

In the event of any recapitalization, reclassification, stock dividend, extraordinary dividend, stock split, reverse stock split or other distribution with respect to common stock, or any merger, reorganization, consolidation, combination,spin-off, stock purchase, or other similar corporate change or any other change affecting common stock, equitable adjustments will be made to the number and kind of Shares available for grant, as well as to other maximum limitations under the 2015 Equity Incentive Plan, and the number and kind of Shares or other terms of the awards that are affected by the event.

Share Counting

Awards that are required to be paid in cash pursuant to their terms will not reduce the Share reserve. To the extent that an award granted under the 2015 Equity Incentive Plan is canceled, expired, forfeited, surrendered, settled by delivery of fewer Shares than the number underlying the award, settled in cash or otherwise terminated without delivery of the Shares, the Shares retained by or returned to us will (i) not be deemed to have been delivered under the 2015 Equity Incentive Plan, (ii) be available for future awards under the 2015 Equity Incentive Plan, and (iii) increase the Share reserve by one Share for each Share that is retained by or returned to us. Notwithstanding the foregoing, Shares that are (x) withheld from an award or separately surrendered by the participant in payment of the exercise or purchase price or taxes relating to such an award or (y) not issued or delivered as a result of the net settlement of an outstanding stock option or stock appreciation right will be deemed to constitute delivered shares, will not be available for future awards under the 2015 Equity Incentive Plan and will continue to be counted as outstanding for purposes of determining whether award limits have been attained. If an award is settled in cash, the number of Shares on which the award is based will not count toward any individual Share limit, but will count against the annual cash performance award limit. Awards assumed or substituted for in a merger, consolidation, acquisition of property or stock or reorganization will not reduce the Share reserve.

Eligibility

Awards under the 2015 Equity Incentive Plan may be granted to any of our employees, directors, consultants or other personal service providers or any of the same of our subsidiaries. The plan allows grants to consultants and other personal service providers, however, this has not been the Company practice.

Stock Options

Stock options granted under the 2015 Equity Incentive Plan may be issued as either incentive stock options, within the meaning of Section 422 of the Code, or as nonqualified stock options. The exercise price of an option will be not less than 100% of the fair market value of a Share on the date of the grant of the option. The Committee will determine the vesting and/or exercisability requirements and the term of exercise of each option, including the effect of termination of service of a participant or a change in control. The vesting requirements may be based on the continued employment or service of the participant for a specified time period or on the attainment of specified business performance goals established by the Committee. The maximum term of an option will be 10 years from the date of grant.

To exercise an option, the participant must pay the exercise price, subject to specified conditions, (i) in cash, or, to the extent permitted by the Committee, and set forth in an award agreement, (ii) in Shares, (iii) through an

open-market broker-assisted transaction, (iv) by reducing the number of Shares otherwise deliverable upon the exercise of the stock option, (v) by combination of any of the above methods or (vi) by any other method approved by the Committee must pay any required tax withholding amounts. All options generally are nontransferable.

Subject to the anti-dilution adjustment provisions and the change in control provisions of the 2015 Equity Incentive Plan, without the prior approval of our stockholders, neither the Committee nor the Board will (a) cancel a stock option in exchange for cash or another award when the exercise price per Share under such stock option then exceeds the fair market value of one Share, (b) cause the cancellation, substitution or amendment of a stock option that would have the effect of reducing the exercise price of that stock option or (c) otherwise approve any modification to a stock option that would be treated as a “repricing” under the then applicable rules, regulations or listing requirements adopted by NASDAQ or other principal exchange on which our common stock is then listed.

Stock Appreciation Rights

A stock appreciation right may be granted either in tandem with an option or without a related option. A stock appreciation right entitles the participant, upon settlement or exercise, to receive a payment based on the excess of the fair market value of a Share on the date of settlement or exercise over the base price of the right, multiplied by the number of Shares as to which the right is being settled or exercised. Stock appreciation rights may be granted on a basis that allows for the exercise of the right by the participant or that provides for the automatic payment of the right upon a specified date or event. The base price of a stock appreciation right may not be less than 100% of the fair market value of a Share on the date of grant. The Committee will determine the vesting requirements and the term of exercise of each stock appreciation right, including the effect of termination of service of a participant or a change in control. The vesting requirements may be based on the continued employment or service of the participant for a specified time period or on the attainment of specified business performance goals established by the Committee. The maximum term of a stock appreciation right will be ten years from the date of grant. Stock appreciation rights may be payable in cash or in Shares or in a combination of both. All stock appreciation rights generally are nontransferable.

Subject to the anti-dilution adjustment provisions and the change in control provisions of the 2015 Equity Incentive Plan, without the prior approval of our stockholders, neither the Committee nor the Board will (a) cancel a stock appreciation right in exchange for cash or another award when the base price per Share under that stock appreciation right then exceeds the fair market value of one Share, (b) cause the cancellation, substitution or amendment of a stock appreciation right that would have the effect of reducing the base price of that stock appreciation right or (c) otherwise approve any modification to a stock appreciation right that would be treated as a “repricing” under the then applicable rules, regulations or listing requirements adopted by NASDAQ or other principal exchange on which our common stock is then listed.

Restricted Stock Awards (RSAs)

RSAs represent Shares that are issued subject to restrictions on transfer and vesting requirements. The vesting requirements may be based on the continued service of the participant for a specified time period or on the attainment of specified performance goals established by the Committee, and vesting may be accelerated in certain circumstances, as determined by the Committee. RSA holders will not be entitled to dividends or other distributions, if at all, until underlying Shares have vested and, unless otherwise set forth in an award agreement, will not have any of the other rights of a stockholder (including, the right to vote), unless and until those Shares vest. Any dividends with respect to an RSA that is subject to performance-based vesting will be subject to the same restrictions on transfer and vesting requirements as the underlying RSA. Until the applicable restrictions are removed or have expired, all RSAs are generally nontransferable.

Restricted Stock Units (RSUs)

RSUs provide the participant the right to receive a payment based on the value of a Share. RSUs may be subject to vesting requirements, restrictions and conditions to payment. RSUs may vest based solely on the continued service of the participant for a specified time period. In addition, RSUs may be denominated as PSUs and may vest in whole or in part based on the attainment of specified performance goals established by the Committee. The vesting of RSUs and PSUs may be accelerated in certain circumstances, as determined by the Committee. RSU and PSU awards will become payable to a participant at the time or times determined by the Committee and set forth in the award agreement, which may be upon or following the vesting of the award. RSU and PSU awards are payable in cash or in Shares or in a combination of both. RSUs and PSUs may be granted together with a dividend equivalent right with respect to the Shares subject to the award. Dividend equivalent rights will be paid at such time as is determined by the Committee in its discretion (including without limitation at the times paid to stockholders generally or at the times of vesting or payment of the RSU or PSU. Dividend equivalent rights will be subject to forfeiture under the same conditions as apply to the underlying RSUs or PSUs. All RSUs and PSUs are generally nontransferable.

Cash Performance Awards

A performance award is denominated in a cash amount (rather than in Shares) and is payable based on the attainment ofpre-established business and/or individual performance goals. The requirements for payment may be also based upon the continued service of the participant during the performance period, and vesting may be accelerated in certain circumstances, as determined by the Committee. All cash performance awards are generally nontransferable. The maximum amount of cash compensation that may be paid to a participant during any one calendar year under all cash performance awards and all other awards that are actually paid or settled in cash is limited to $2.0 million.

Effect of Change in Control